The Corporate Transparency Act (CTA) is a federal law that requires businesses to disclose who really owns them—helping to combat financial crimes like money laundering and fraud.

As of today, November 27, 2024, Northfield, Minnesota business owners have 35 calendar days (or 25 business days) left to file their Beneficial Ownership Information (BOI) report with FinCEN—don’t delay, or you could face fines of $500 per day!

Key Steps for Northfield Businesses:

-

Determine if Your Business Must File

-

Who needs to file? Most U.S.-formed corporations, LLCs, and similar entities qualify, except exempt groups like banks, public companies, and nonprofits.

-

-

Identify Your Beneficial Owners

-

Definition: Anyone with substantial control or 25%+ ownership.

-

Tip: Use tools like ZenBusiness for clarity.

-

-

Gather Information

-

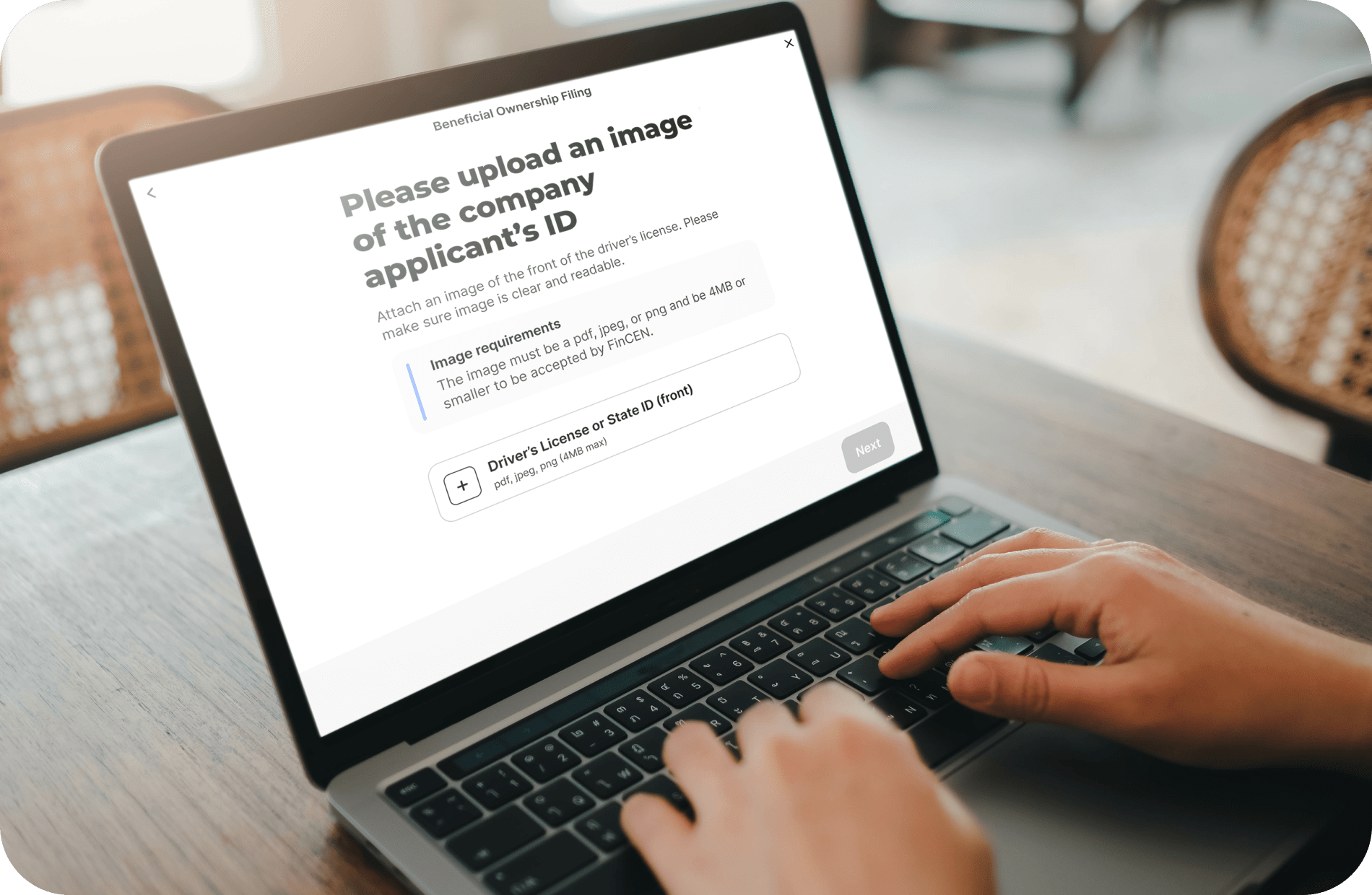

What you need: Business name, address, EIN, and owner details like name, address, DOB, and ID documents.

-

-

File Your BOI Report

-

Deadlines: Existing companies: 01/01/2025;

Companies formed in 2024: 90 days after creation;

New companies (2025+): 30 days after creation. -

ZenBusiness can help simplify filing.

-

What Makes a Business a "Reporting Company"?

A “reporting company” is any corporation, LLC, or similar entity formed in the U.S. unless exempt. Exemptions include banks, large public companies, and nonprofits. For example, a small bakery in Northfield likely needs to file unless it qualifies for an exemption.

Who Qualifies as a Beneficial Owner?

A beneficial owner is anyone who:

-

Controls the company (e.g., a CEO); OR

-

Owns 25% or more of the company.

Example: If a Northfield landscaping company has four co-owners, each with 25% ownership, all four are beneficial owners and must be listed in the BOI report.

Required Information for BOI Reports

To file your BOI report, you'll need:

-

Business Information: Name, address, EIN.

-

Owner Information: Names, birth dates, addresses, and official ID details.

Both business and owner details must be submitted through FinCEN’s secure online portal.

Filing Deadlines

-

Existing Businesses (formed before 01/01/2024): File by 01/01/2025.

-

New Businesses (formed in 2024): File within 90 days of creation.

-

New Businesses (2025+): File within 30 days of creation.

Penalties for Missing Deadlines

Non-compliance with BOI reporting can lead to fines of up to $500 per day and potential imprisonment. However, mistakes can be corrected within a 90-day safe harbor window without penalties.

Get Help from ZenBusiness

ZenBusiness offers expert assistance in identifying beneficial owners, gathering necessary information, and filing BOI reports accurately and on time. Their tools save time and ensure compliance. Click here to learn more and get started today.

Additional BOI Resources:

Prepare now, Northfield businesses, and avoid last-minute stress. File your BOI report today!

Your input makes a difference! Take a few minutes to complete our BOI survey by December 18, 2024, and for every 25 responses, our Chamber will receive a $100 donation. [Take the survey here!] Thank you for supporting our Chamber and sharing your feedback!

*As of December 3, 2024, a Texas federal district court has issued a preliminary injunction for all states to block the CTA and its relevant regulations. However, filing your BOI will help you avoid fines if this injunction is overruled.

This Hot Deal is promoted by Northfield Chamber of Commerce & Tourism.